Grief has a way of revealing the things we wish we’d done differently. Again and again, when people share their regrets with me, it’s rarely about money, achievements, or chances they didn’t take. It’s about the conversations they never had.

1️⃣ Start having conversations! Yes, they may be uncomfortable, but through ongoing discussions (because it’s never just one), you’ll better understand the wishes of your parents, loved ones, or even you and your spouse. This will allow you to make a plan. The more time you take to plan, the more options you’ll have.

2️⃣Listen: Before offering solutions, take the time to listen to your friend, spouse or parents’ thoughts, any worries, and what their long term goals are. Feeling heard can make all the difference.

3️⃣ Observe Patterns, Not Just Moments: A single incident might not be cause for concern, but noticing changes in mobility, memory, or daily habits over time can help guide the conversation.

4️⃣ Ask, Don’t Assume: Instead of assuming what’s best, ask open-ended questions about their experiences and what support they might find helpful.

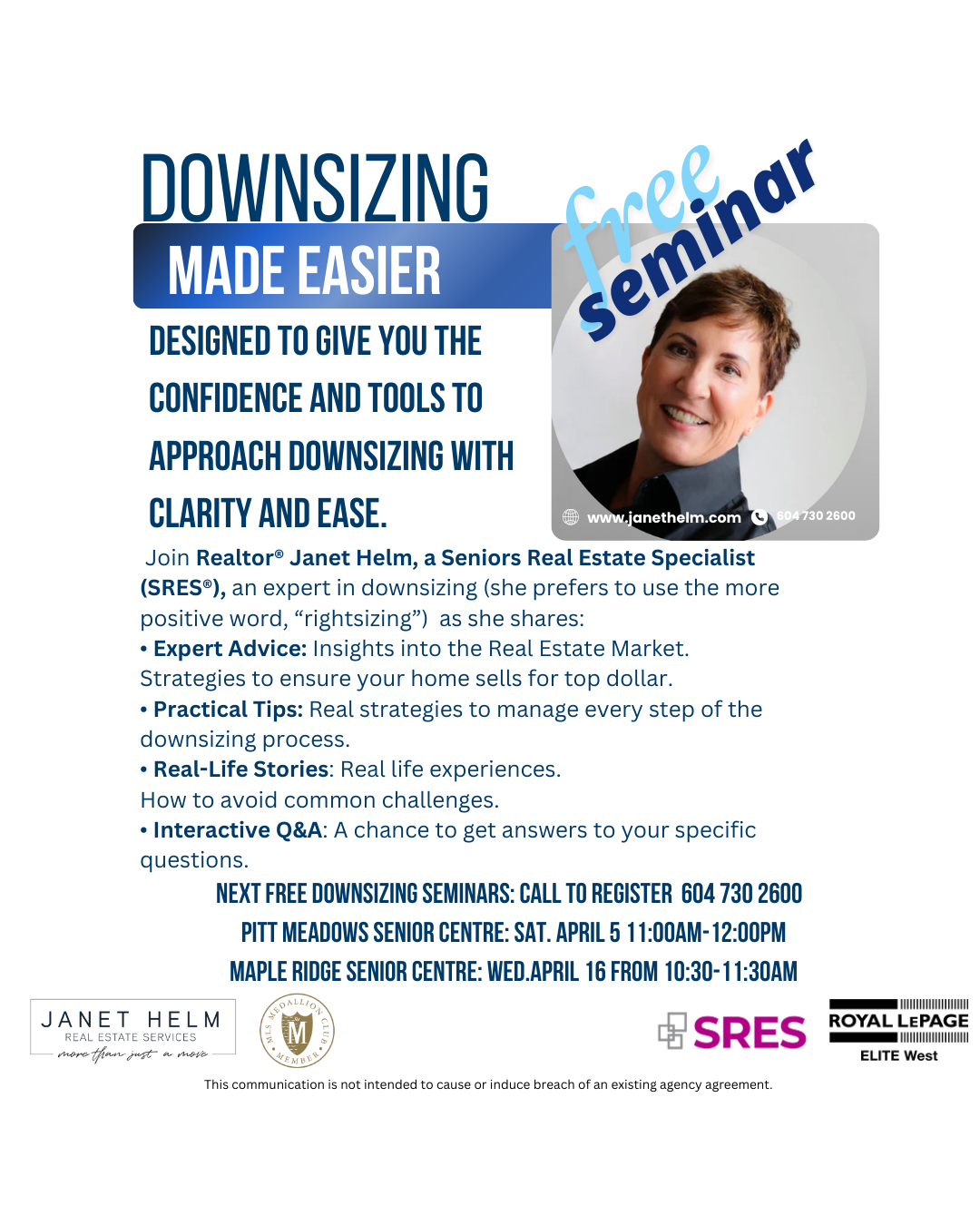

5️⃣ Prioritize Independence: Focus on solutions that preserve autonomy—whether it’s home modifications, ride-sharing options, or tech tools—rather than emphasizing limitations or immediate need to sell and move. This could include referring an age in place specialist, offering meals, drives, sharing resources for cleaning and or yard help. If interested in moving, research communities, attend retirement community tours together. You may want to involve close friends or family in the decision and options. As a Seniors Real Estate Specialist (SRES®) I welcome sitting down with entire families and or friends and share options so everyone receives the same information, questions are answered, and plans can be made with clarity and confidence.

6️⃣Use ‘We’ Instead of ‘You’: “Let’s figure this out together” feels more supportive than “You need to…” and encourages collaboration.

7️⃣Be Proactive, Not Reactive: Discuss topics like driving, home safety, or financial planning, estate planning, updating wills, power of attorney, advance health care plan before they become urgent issues. Early conversations allow for better choices.

8️⃣Speak with Respect: Avoid talking down or dismissing concerns. Honour their life experience and perspective. Approach with compassion.

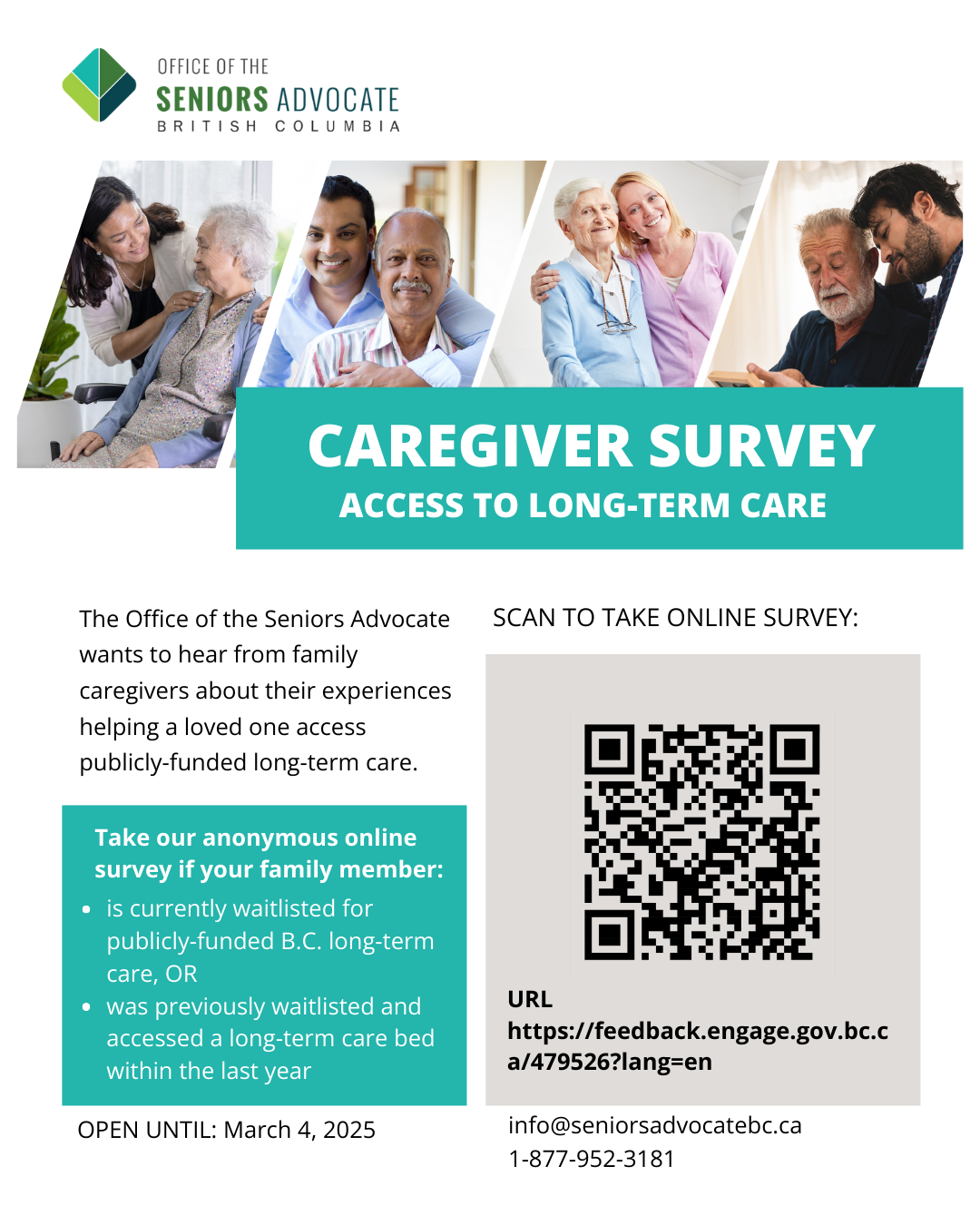

9️⃣ Ask for Guidance: Caregiving experts, senior organizations, and trusted advisors can help navigate difficult discussions and offer solutions. If selling is an option for you, it is my commitment to provide you a clear understanding of your position, share move management solutions if you were to sell and move. I’ll also help you prepare your home to maximize its value. Your plan on your terms and timeline, always!